Yesterday, Today, and Tomorrow1

This is a digression from a series of posts on threats to Canadian democracy because there was some good news yesterday. But the good news exposed Threat 3, relief and Threat 4, despair when the relief didn’t last.

Yesterday reminded me of today

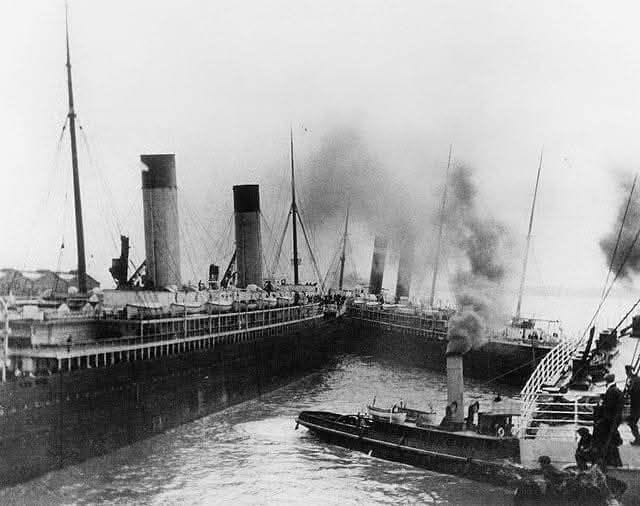

On April 10, 1912, as she was leaving Southampton Harbour, RMS Titanic’s powerful wake snaps lines securing the American Line’s SS New York, drawing her within 2 metres of Titanic. Only swift action by Titanic and her tugs avoid a collision that would have brought a premature end to her maiden voyage.

No doubt everyone aboard gave a sigh of relief. Things looked bad there for a while.

Yesterday, relief

Yesterday Trump paused the recipricol tariffs. People rejoiced and stock markets nearly everywhere “soared”.

US stocks skyrocketed higher after President Donald Trump announced that he authorized a 90-day pause on the “reciprocal” tariffs that had gone into effect Wednesday, with the exception of China.

Wall Street had been on edge, looking for any sign that Trump might shift his approach to his punitive tariffs. So when Trump posted on social media that he authorized a pause on most reciprocal tariffs, investors were ready to dive in.

US stocks immediately surged, posting a historic rally. The Dow skyrocketed 2,963 points, or 7.87%. The S&P 500 shot up 9.52%. The tech-heavy Nasdaq soared 12.16%. - https://www.cnn.com/2025/04/09/investing/global-stock-market-reciprocal-tariffs-hnk-intl/index.html

The “soar” was relative. Little more than a month ago, on February 28th the S&P 500 closed at 5,954.50 and the Dow Jones Industrial Average closed at 43,840.91. CNBChttps://www.cnbc.com/2025/02/27/stock-market-today-live-updates.html

Today, despair resumes

The “soar” was short lived

“The US stock market, fresh off its third-best day in modern history, is sinking back into reality: Although President Donald Trump paused most of his “reciprocal” tariffs, his other massive import taxes have already inflicted significant damage, and the economy won’t easily recover from the fallout.

The Dow, after rising nearly 3,000 points Wednesday, was set to open lower by more than 500 points, or 1.3%, Thursday. S&P 500 futures fell 1.7% and Nasdaq futures were 1.9% lower. The S&P 500 is coming off its best day since 2008, and the Nasdaq on Wednesday posted its second-best daily gains in history. - https://www.cnn.com/2025/04/10/investing/stock-market-dow-tariffs/index.html

And tomorrow, an opportunity

The crisis has not been averted. At best it has been diarized. And Trump’s erratic incompetance is, as always, praised by his lackeys, dupes, and poodles as the art of the deal and multi-dimensional chess.

He didn’t abdicate but he did capitulate to reality. And that’s a start and a reminder of the limits of power.

Given the popularity pausing is enjoying, I’m going to pause this series on threats at 3 and 4 and put something together on the opportunities this moment offers.

https://www.imdb.com/title/tt0057171/